Social Schemes

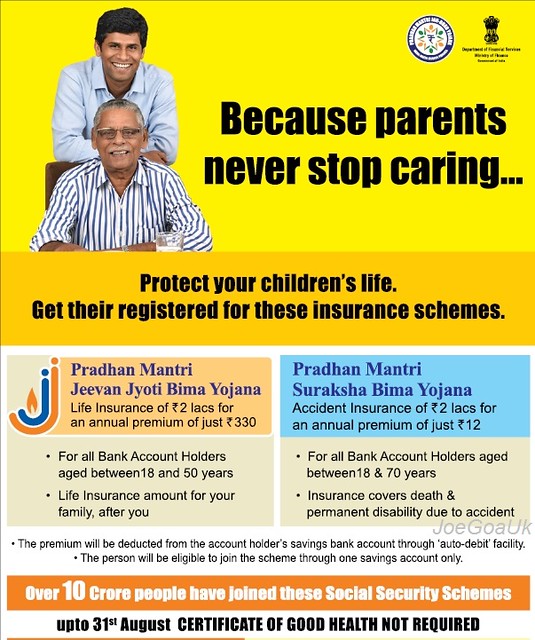

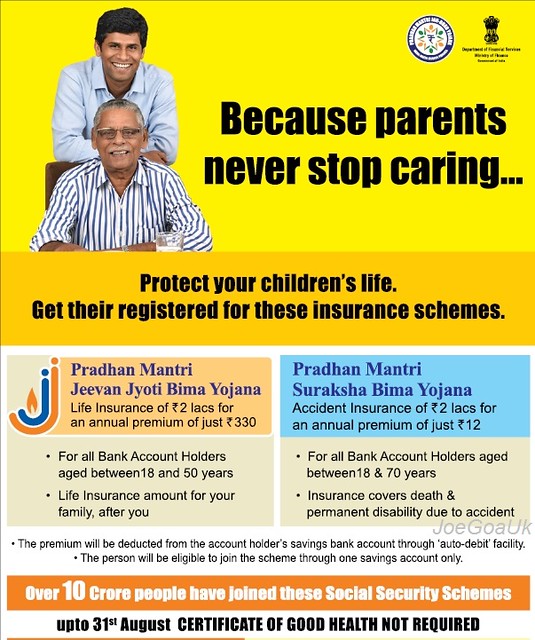

1. Pradhan Mantri Surakhsha Bima Yojana,

2. Pradhan Mantri Jivan Jyoti Bima Yojana,

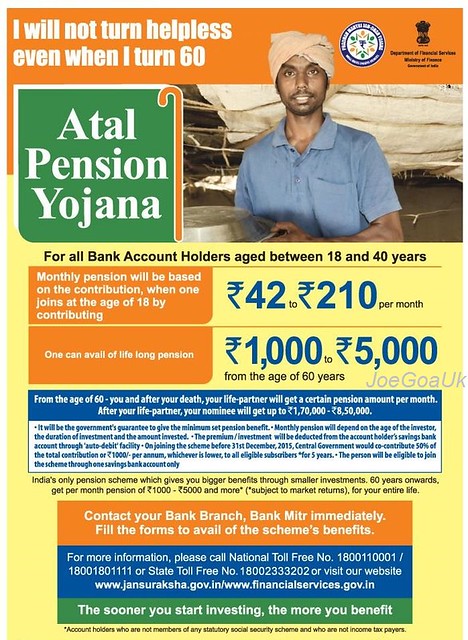

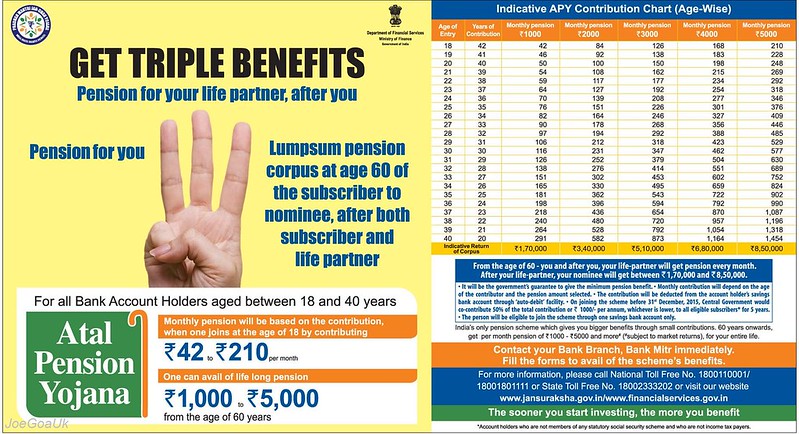

3. Atal Pension Yojna,

4. Sukanya Samriddhi yojana

1. Pradhan Mantri Surakhsha Bima Yojana,

2. Pradhan Mantri Jivan Jyoti Bima Yojana,

3. Atal Pension Yojna,

4. Sukanya Samriddhi yojana

Directorate of Financial Services, Ministry of Finance, Government of India

Schemes introduced January 2015

Prime Minister's Life Insurance Scheme, Accidental death and Disability scheme, Atal Pension Scheme, Girl Child Prosperity scheme

1. Pradan Mantri Surakhsha Bima Yojana (PMSBY)

Accidental death and Disability Insurance scheme

You or your family get Rs. 2 Lac cover for Just Re.1 per month i.e. Rs. 12 per year.

Just contact your Bank once and they will open the Insurance account and pay the premium for you year after year from your saving account via auto-debit facility.

Everyone should go for it (for 18 -70 years only)

Even if you register at 18 and die at 70 due to an accident your total contribution for the period would be about Rs.624 (i.e. 52x12 assuming the premium remained same) but your family will get Rs.2 lac. However, value of Rs.2 Lac in 2067 could be just 20,000, also the annual premium Rs.12 you pay after 2020 would be like going down to Rs.8 Rs.5 and Re.1 .

Note: If you do not die in an accident before your 70th birthday or you die a natural death you get nothing.

However, full disability due to accident – Rs 2 Lakh and for partial disability (e.g loss of 1 eye or leg, hand etc – Rs 1 Lac paid. 2% TDS deduction if payment is over 1 lac or submit Form 15G or Form 15H. Premium may or may not go up after 3 years

Note:

In Goa, one can also claim Rs. 2 Lac for death due to Road accident, 1.5 Lac for permanent injury

Eligibility: Lower income Goan family (atleast 15 years residence) whose annual income does not exceeds Rs.3 Lac.

Non-Goans or victims outside Goa can claim upto Rs.50,000

Contact Directorate of Transport Dept for claim etc

https://www.flickr.com/photos/joegoaukextra4/19038750479/

2. Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

You or your family get Rs. 2 Lac cover for Just Re.1 per month i.e. Rs. 12 per year.

Just contact your Bank once and they will open the Insurance account and pay the premium for you year after year from your saving account via auto-debit facility.

Everyone should go for it (for 18 -70 years only)

Even if you register at 18 and die at 70 due to an accident your total contribution for the period would be about Rs.624 (i.e. 52x12 assuming the premium remained same) but your family will get Rs.2 lac. However, value of Rs.2 Lac in 2067 could be just 20,000, also the annual premium Rs.12 you pay after 2020 would be like going down to Rs.8 Rs.5 and Re.1 .

Note: If you do not die in an accident before your 70th birthday or you die a natural death you get nothing.

However, full disability due to accident – Rs 2 Lakh and for partial disability (e.g loss of 1 eye or leg, hand etc – Rs 1 Lac paid. 2% TDS deduction if payment is over 1 lac or submit Form 15G or Form 15H. Premium may or may not go up after 3 years

Note:

In Goa, one can also claim Rs. 2 Lac for death due to Road accident, 1.5 Lac for permanent injury

Eligibility: Lower income Goan family (atleast 15 years residence) whose annual income does not exceeds Rs.3 Lac.

Non-Goans or victims outside Goa can claim upto Rs.50,000

Contact Directorate of Transport Dept for claim etc

https://www.flickr.com/photos/joegoaukextra4/19038750479/

2. Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Looks like this is Term life Insurance Policy .

Life Insurance Cover of Rs.2 Lac for those who are 18 - 50 years old only.

You pay Rs. 27.5 per month or annual payment of 330 to be deducted from your saving account annually by auto-debit. Aadhar Card required

In this scheme your family gets Rs. 2 Lac after your death due to any cause (accidental, natural death but please do not commit suicide). See 1 above for actual value of 2 lacs etc.

If you take up this insurance at 18 and die say at 55, your total contribution would be Rs.12,210 (Maximum*) i.e. 37x330 (assuming the premium remains unchanged), your family get 2 lac.

*You pay upto the age of 55 years.

Notes:

Your family will get nothing if you don't die before you attain 55 years of age (Term life policy)

If you die in an accident before 55 you get double or triple benefit Rs.2lac + Rs.2 Lac (assuming you also have Insurance No. 1 above PMSBY), Goans could get upto 6 lacs in case of road accident death as mentioned in 1 above.

If you join above scheme before 31st August 2015, no Good Life Certificate required

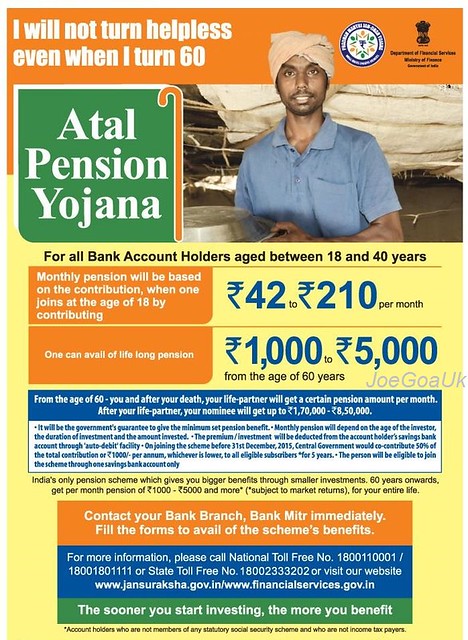

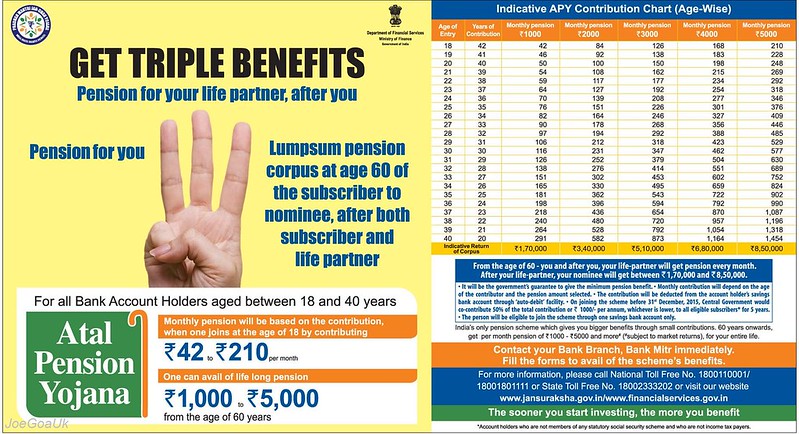

3. Atal Pension Yojana

Details coming soon

in the mean time refer the official Govt. ads below. click on links and click again on pic for larger view / reading

https://www.flickr.com/photos/joegoaukextra4/18602413264/

https://www.flickr.com/photos/joegoaukextra4/19228620211/

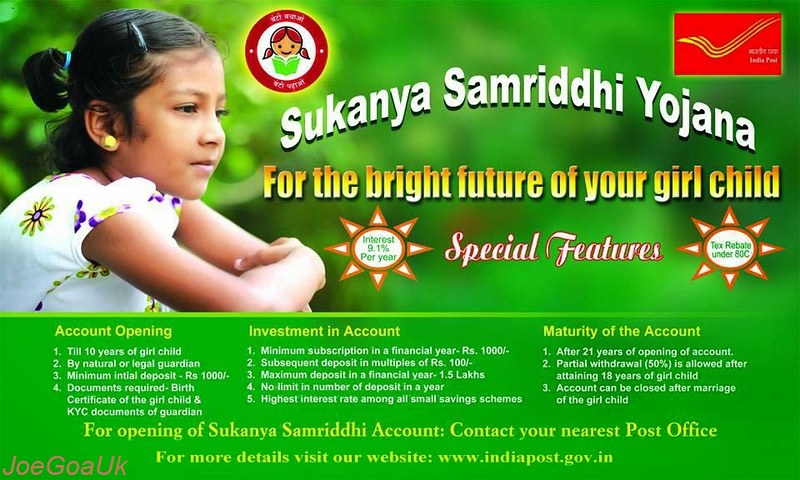

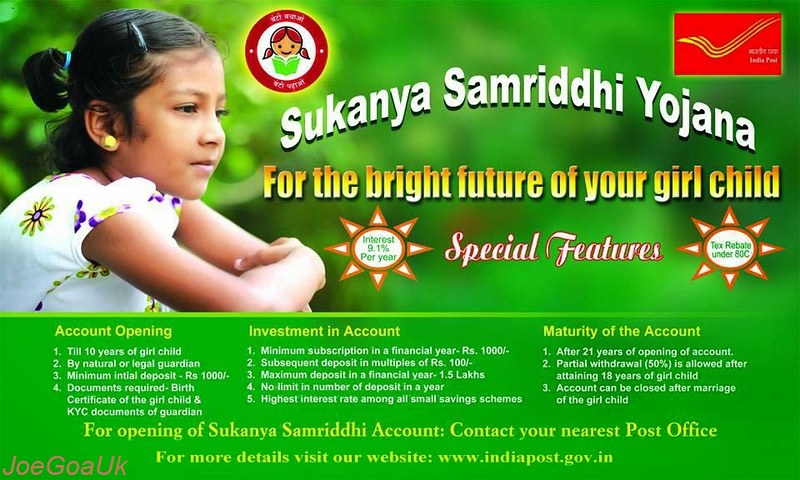

4. Sukanya Samriddhi yojana

Girl Child Prosperity Scheme

This is basically a recurring deposit scheme with highest rate of Interest currently 9.2%

more details coming soon

in the meant time refer the official Govt. ads below. click on links and click again on pic for larger view / reading

https://www.flickr.com/photos/joegoaukextra4/19198799596/

Note:

This info blog in the interest of general public and may contain inadvertent errors or omissions, (corrections welcome). Always refer Govt Sites or banks for correct info and updates

Life Insurance Cover of Rs.2 Lac for those who are 18 - 50 years old only.

You pay Rs. 27.5 per month or annual payment of 330 to be deducted from your saving account annually by auto-debit. Aadhar Card required

In this scheme your family gets Rs. 2 Lac after your death due to any cause (accidental, natural death but please do not commit suicide). See 1 above for actual value of 2 lacs etc.

If you take up this insurance at 18 and die say at 55, your total contribution would be Rs.12,210 (Maximum*) i.e. 37x330 (assuming the premium remains unchanged), your family get 2 lac.

*You pay upto the age of 55 years.

Notes:

Your family will get nothing if you don't die before you attain 55 years of age (Term life policy)

If you die in an accident before 55 you get double or triple benefit Rs.2lac + Rs.2 Lac (assuming you also have Insurance No. 1 above PMSBY), Goans could get upto 6 lacs in case of road accident death as mentioned in 1 above.

If you join above scheme before 31st August 2015, no Good Life Certificate required

3. Atal Pension Yojana

Details coming soon

in the mean time refer the official Govt. ads below. click on links and click again on pic for larger view / reading

https://www.flickr.com/photos/joegoaukextra4/18602413264/

https://www.flickr.com/photos/joegoaukextra4/19228620211/

4. Sukanya Samriddhi yojana

Girl Child Prosperity Scheme

This is basically a recurring deposit scheme with highest rate of Interest currently 9.2%

more details coming soon

in the meant time refer the official Govt. ads below. click on links and click again on pic for larger view / reading

https://www.flickr.com/photos/joegoaukextra4/19198799596/

Note:

This info blog in the interest of general public and may contain inadvertent errors or omissions, (corrections welcome). Always refer Govt Sites or banks for correct info and updates